Last year (2024) in September I wrote up the below pitch and sent it in sequence to VIC and MicroCapClub. Both rejected it. Aquis was taken over in November at around twice the stock price in September ‘24. Btw I didn’t identify a takeover as one of the possible catalysts… I was invested but not nearly as much as I should have been. Here goes:

How many stock exchanges are there in London?

You may be surprised to find out that it’s not one. The second stock exchange I’m talking about is the 7th largest in Europe with over 5% market share. It’s not the London Stock Exchange (LSE) – which incidentally is the fourth largest in with market share of 11%.

I’m talking about Aquis Stock Exchange (AQSE). It’s owned by Aquis Exchange PLC (AQX). It’s a growing business. It has just 75 employees and generates ~£24m in revenue and £5.2m in PBT - it’s worth approx £75m in market value and £64m in EV. Few people pay any attention to them at the moment.

Company Overview – with useful video links

Aquis Exchange PLC is Europe's challenger exchange, they have proprietary technology, they offer primary listings and secondary trading of equities, along with global licensing of proprietary technology. They operate in the UK and EU (via a French entity). They have these divisions:

Aquis Markets operates lit and dark order books, covering 16 European markets. For its lit books, Aquis uses a subscription pricing model which works by charging users according to the message traffic they generate, rather than a percentage of the value of each stock that they trade.

These are MTFs (Multilateral Trading Facilities) also known as ATS (Alternative Trading Systems) in the US: https://www.investopedia.com/terms/m/multilateral_trading_facility.asp

Aquis Technologies is the software and technology division of Aquis. It focuses on building better markets via the creation and licensing of cutting-edge, cost-effective exchange infrastructure technology and services, including matching engine and trade surveillance solutions.

Aquis Stock Exchange (AQSE) is a stock market providing primary and secondary markets for equity and debt products. It is authorised as a Recognised Investment Exchange, which allows it to operate a regulated listings venue. The AQSE Growth Market is divided into two segments 'Access' and 'Apex'; the Access market focuses on earlier stage growth companies, while Apex is the intended market for larger, more established businesses.

Aquis Data generates revenue from the sale of data derived from Aquis Markets and Aquis Stock Exchange to market participants.

Aquis is authorised and regulated by the UK Financial Conduct Authority and similar authority in France's to operate Multilateral Trading Facility businesses in the UK & Switzerland markets and in EU27 markets respectively. Aquis Exchange PLC is quoted on the Aquis Stock Exchange and on the AIM Market (AIM) of the LSE.

Why I think it’s a good investment opportunity:

1) Unique business model – in their Markets division they don’t change per transaction. They have a subscription model up to an all-you-can-eat. The idea is that with low to zero marginal cost their customers’ behaviour changes and they will trade much more via them. They also changed the rules recently to allow prop-trading. This should drive revenue up – there is some evidence of this in the H1 2024 results.

2) New wins and investment in the Technology division. They recently won a central bank contract (Bank of Colombia) – they beat NASDAQ to the contract and as per management it has completely changed how they are being perceived by potential customers. In the pipeline they have 6 RFPs with national stock exchanges or central banks. They plan to invest in the technology to drastically increase its addressable market (they address just about 11% of it now). Their technology is new where current players’ tech is old (sometimes 20-30 years). They are the first provider to have an exchange in the cloud – working closely with AWS – perpetual matching engine which never needs to switch off. They plan to invest £6m in the technology division over three years. The CFO puts it in context – this investment is basically paid for by one medium sized contract of £50k+/month running over 5+ years (inflation, renewals etc). They have cash to finance this from own resources.

3) Stock Exchange division moat - it’s very hard to build an exchange from scratch. The regulatory hurdles are high. They operate in both the UK and Europe. They simplified the listing process – templates etc. The also have Recognised Investment Exchange status – which should the IPO market pick up would be quite valuable.

4) In the Data division – they started charging exchange members additional data fees which started showing in the numbers in H1 2024.

5) The CEO is also the founder and veteran of the industry. He’s a bit of a fanatic in terms of promoting the importance of capital markets. He wants to see 24/7 trading, on anything from anywhere. He believes that competition is great for exchanges and that introduction of NASDAQ was the catalyst that really kicked off the capital markets in the US.

6) The management pay themselves richly but not outrageously so ~ £1.8m total to COE, CFO and special adviser in 2023. They seem to be a very tightly knit group with the core group of the original startup employees still around. Glass door reviews are very good (but not many)

7) Shareholders – the CEO holds around 5%, Rich Ricci the former Barclays’ executive owns around 8% (link...). Gaudenzio Roveda an Italian venture capitalist owns another 9%. XTX Markets, an algorithmic trading specialist owns 9%.

Valuation

Although this kind of business doesn’t have an unlimited runway, it can certainly become bigger, much bigger. Especially in the technology segment which they are investing heavily in. They want to expand their reach of the addressable market, meaning trading different assets + they talk about trading non-traditional assets – this can mean anything that requires a fast matching engine including concert tickets or airline seats. Obviously, any technology is ripe for disruption, but I’d argue that in this case there is a large barrier to entry and premium placed on a brand. Especially after they won the central bank contract (BDLR) which they claim shocked the main competitors (read NASDAQ). At a valuation of 12 EV/EBIT I’d argue that little/no growth is priced in. They have a large return on capital ~ 20+%, internal investment in the technology business should improve results further. With growth of around ~10-20% p/a they should easily be worth about double of the current valuation.

Using DCF with these inputs:

Gives us upside of about 100% (see resource 10 below). If we apply assumed growth rate in the high-growth period of 15%, it’s around 190%. DCF can be deceptive as it will take any numbers until it provided the right answer. Another way to look at the DCF is to find out what would be rate of growth at which the valuation would be justified. In this case it would be about 4% from now on until eternity – hard to believe for a tech company with potentially very valuable technology to license.

On a relative valuation note - LSEG which is orders of magnitude larger and with no comparable potential for fast growth is valued at 37 EV/EBIT where AQX is at 12 or so.

Why is it cheap?

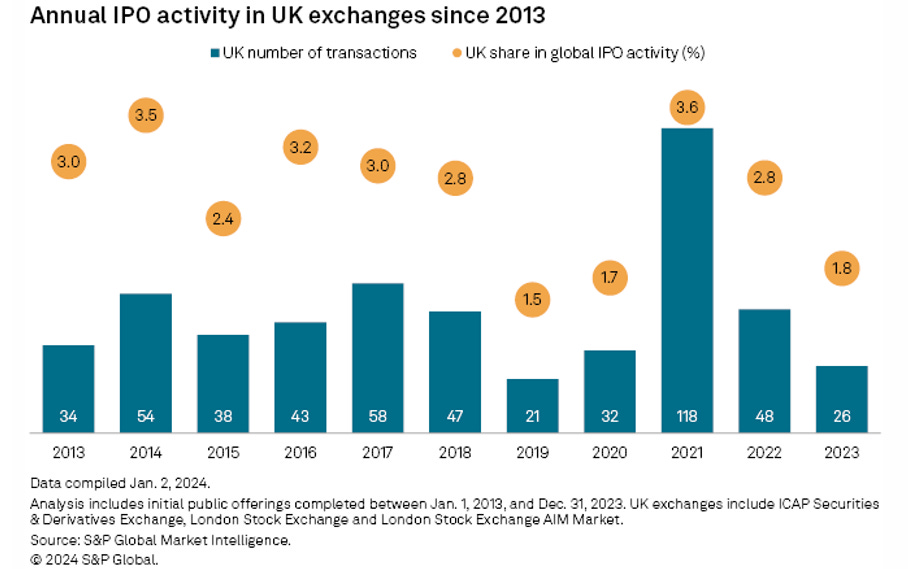

Stagnation in listings – they listed just two new businesses on the Exchange in 2024. There has been a big drop in listings overall this year - LSE listed just eight new companies (link...). Historically the number is about 45 on average (link...). Any reversal to the mean could be beneficial in this division. Investors may be making the mistake of conflating the exchange division with the whole business. This is actually the smallest of the divisions easily eclipsed by the revenue of markets, data and technology divisions.

Little coverage – just three analysts cover it. Even the videos where the CEO explains the model have had very few views (low hundreds). There is some coverage by a few notable private investors (links 3-5 below)

Small market cap – it’s not in any of the indexes and institutional ownership is relatively low.

Catalysts

Big technology contract wins. Any new contract can mean a revenue upside of £500-600k/pa or more for them – they have 13 contracts in advanced stage – see (link 3 below).

IPOs market picks up. This would have little impact on Aquis’s finances but would improve the perception of the exchange.

Shift in perception. If more investors start understanding Aquis as a fintech rather than just an exchange it could lead to rerating.

Stock buyback with the cash pile they have.

Risks

The IPO market remains subdued – if my hypothesis about investors conflating the state of the exchange (and especially IPOs) with the whole business then a subdued IPO market is a bad thing

No major short-term contract wins in the technology space. This would be the biggest blow here.

There is somewhat a key-man dependency on the CEO/founder who in instrumental in driving it forward. I don’t expect him to quit though – he seems to be on a mission.

Conclusion

Aquis is a business with high regulatory barrier to entry. It the UK it operates in duopoly with the London Stock Exchange. By building the exchange they realised they had a very valuable technology which other players (whose technology is out-dated) are interested in. If they grow reasonably, the upside should be considerable.

Resources

1) https://www.investormeetcompany.com/meetings/interim-results-346

2) https://www.investormeetcompany.com/meeting/interim-results-346/presentation.pdf

5) https://knowledge.sharescope.co.uk/2021/11/17/small-cap-spotlight-report-aquis-exchange/

7) https://www.thearmchairtrader.com/aquis-exchange-results-profits-forecast-trading/

8)

10) DCF:

02/10/2024

https://www.telegraph.co.uk/money/investing/stocks-shares/how-london-resurrected-stock-market/:

+ little pushback to price increases or re-banding of services

+ consolidated tape would be a very good thing for them

+ selling equinox to outside of financial markets (anything that needs matching engine) – airlines, tickets etc

Who runs it:

CEO - Alasdair Haynes (https://www.rblt.com/emsc-biography/alasdair-haynes)

Alasdair is the founder and CEO of Aquis Exchange PLC: a creator and facilitator of next-generation financial markets through the provision of accessible, simple and efficient stock exchanges, trading venues and technology.

One of the FT1000’s fastest-growing companies in Europe (and in the UK’s top 100), Aquis is a challenger and innovator in capital markets. It consists of three divisions: Aquis Markets, a subscription-based exchange offering pan-European cash equities trading; Aquis Technologies, which develops and licenses next-generation exchange technology globally; and Aquis Stock Exchange, a growth and regulated primary exchange delivering capital to companies via the listing and trading of shares.

In addition to running Aquis, Alasdair is the Chairman of TheCityUK’s Business Council and he also sits on the FCA’s Practitioners’ Panel. Prior to establishing Aquis, Alasdair was CEO of Chi-X Europe (now Cboe) and CEO of ITG International (now Virtu). Alasdair began his 30 plus-year career in the City with Morgan Grenfell and has held senior positions at a number of investment banks, including HSBC and UBS.

https://www.thetradenews.com/the-big-interview-alasdair-haynes/

https://www.marketswiki.com/wiki/Alasdair_Haynes

https://www.thetradenews.com/broadridges-ltx-launches-genai-powered-list-trading-functionality/