The ideal company to invest in

What happens if a company grows net income without growing the capital employed?

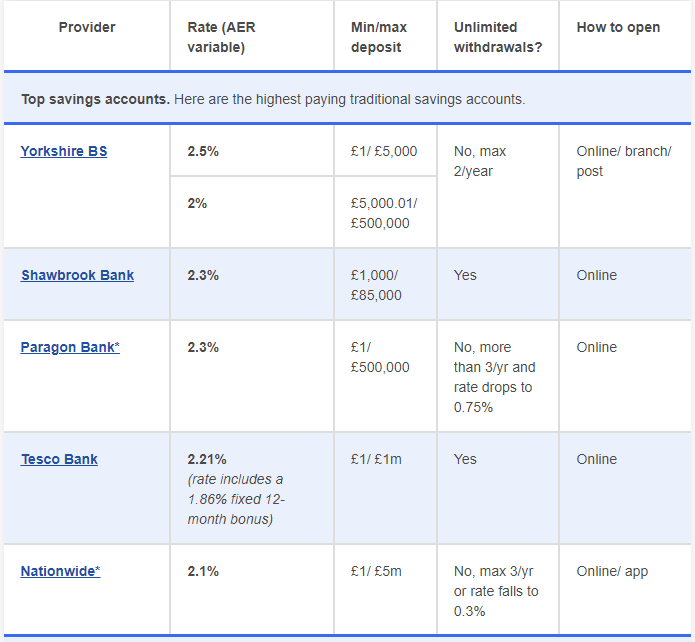

Let’s say you have hundred thousand pounds to invest in something. If you want security you just put it into a savings bank account. You may get ~ 2% currently in the UK - moneysavingexpert comparison:

If you don’t need the money now you can get bit more by putting it into a fixed account - say 3.5%. Let’s be generous and say that your money will grow at 5% rate per year. Due to compounding you’ll have around 163,000 after 10 years. This money is your capital.

If you were a company, your capital would be the money you need to run the business. This would be the money you’ve spent on any premises and equipment you have bought plus the money your buyers owe you minus the money you owe to your suppliers. It also includes any cash you have in the bank. Let’s say this capital is also equal to £100K.

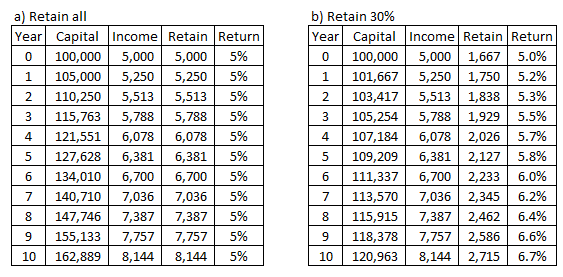

Let’s say say that your business makes £5,000 in the first year - this is your net income. That would make your return on capital employed 5%. Let’s say that out of that £5,000 you don’t pay out anything to the owner and retain it all in the business. Your capital will be £105K at the end of the year. If you repeat this process year by year, you will have around £163K by the end of year 10. This would be exactly the same as with your savings account above.

You’re growing your capital year by year and that’s great. However, what if you could grow your net income without retaining all the income in the business?

Let’s assume two scenarios - a) we retain all the income, b) we distribute two thirds to the owner and retain just one third in the business. If we can still grow the income year by year by 5%, here is the comparison:

To me the business on the right is much more attractive because its return on capital grows year by year. As part of the process we also managed to distribute £47,000 to the owner.

The question is do businesses like these even exist and can they be bought on the market?