The below is not an investment advice. These are mostly notes to self so I have something to inspect when this inevitably goes wrong.

TL;DR: Knights Group Holdings Plc is a law firm roll-up. It’s the biggest firm outside of London. They actively avoid London. They focus on the regions and they are doing well. The stock is also pretty cheap. The management owns 20+% and keeps on buying. They make good return on tangible capital. They’re growing quickly - 20% y/y. Other law firms are priced at much higher multiples. On the negative side: they have taken on quite a bit of debt. They are not as efficient as they could be (in comparison with competition).

Is it absolutely cheap?

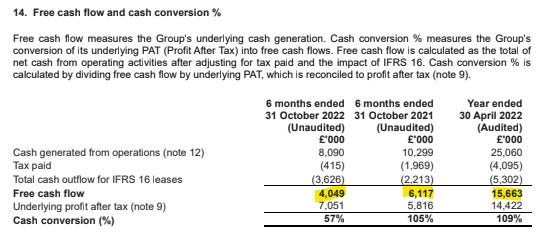

I think they probably are. They generate very decent free cash-flow - in the range of £10-15m per year.

The above is for 6 months. Let’s call it £10m going to the owners. They spend an awful lot of it on various acquisition related costs. But let’s assume they’d stopped buying new firms. That money would instantly hit the bottom line. They could also quickly pay back the debt (of which there is about £35m) to save on the interest expense. They would instantly stop growing as quickly as they are now - about 20% year on year. But they could realistically grow by 5% for a very long time. A quick DCF tells me that there is some value in it. I’m not even bothering to guess a terminal value after year 10. Just gathering the cash flows it would pay for itself and offer some return. So that’s the base scenario.

What if they keep on growing by acquisition? It’s hard to grow by 20% for a long time. What if they grew by 20% for another five years and then reverted to 5% growth?

This is obviously way too simplistic. But if they can grow for a bit longer and keep on generating cash, it would be more valuable than the market thinks. There is arguably not that much margin for error.

Is it relatively cheap?

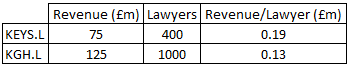

Best to look at EBIT/EV. There is another listed law firm in the UK called Keystone Law Group (KEYS.L). Keystone has a different kind of business - they are very asset light, they operate a decentralised model where their lawyers are effectively free-lance contractors using the company as a platform - they get business through it and they pay the company about a third of their income. This may well be a better business model going forward. I suspect though that Knights with their more traditional model will capture bigger clients. At the moment they could also squeeze out more out of the business - their fee-generating lawyers generate:

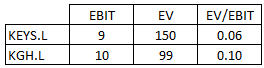

On EBIT/EV measure Knights are cheaper than Keystone:

The market clearly likes the asset-light approach more than the indebted asset (and goodwill) heavy business of Knights.

Why is it cheap?

I suppose because they have a lot of leverage. They have some £35m in net debt. The rate they pay is about 2% above SONIA which is about 4% now. So all in all they will pay around £2m+ on the borrowing. Given the amount of cash they generate and will generate it’s well covered. Another reason I suppose is that people assume the economy will slow and business will evaporate. That may well happen. They have some big industrial and real-estate clients. They are not dependent on one industry. In case the economy does tank they may have some way to lower costs - eg lowering compensation of the 1000+ fee-earning lawyers they employ.

Are the acquisitions any good?

In FY22 they paid about £10.5m for acquisitions. There are some conditional future payments etc so let’s call it £15m. As per FY22 annual report (p98) they expect that the acquisitions would make contribution of about £18m (4.2+9.4+4.5) if acquired at the start of reporting period. Assuming a conservative 10% operating margin (on average theirs is historically higher), you’d expect them to get about £1.8m of operating income from the acquisitions so not too bad on £15m investment.

Why are they borrowing money instead of issuing equity?

The CEO holds about 22% of the company and he keeps on buying large amounts of the stock. Other insiders have some (much smaller) stakes but also keep on buying.

I suppose equity financing would come with dilution and further loss of control. They however do also pay for some of the acquisitions partly in shares. They increased share count by some 20% over the last five years or so.

Upside

Improve efficiency - increase revenue per fee-earning lawyer to the level the competition is achieving. Consolidate operations. I think the market is undervaluing the earning power of the business.

Risks

The biggest one for me is that the acquisitions going forward are no good and they keep on buying more to keep the momentum. Another is cost of debt servicing but I see that as low risk as they are well covered for interest payments.

In summary

Good business growing strongly albeit with a lot of debt. It looks cheap on both absolute basis - ie what would I get back if I owned the whole business. And relative compared to the competition but arguably the competition may have a better business.

As per their latest results - https://tools.euroland.com/tools/PressReleases/GetPressRelease/?ID=4442589&lang=en-GB&companycode=services - they are now worth a bit more £105m in market cap + $38m in net debt for £145m EV. They are growing revenue and improving operational metrics. Weirdly they have moved borrowings from non-current liabilities to current liabilities on the balance sheet which makes no sense to me - I've asked them, waiting for reply

they now expect to make £25m PBT https://data.fca.org.uk/artefacts/NSM/RNS/4774894.html in the year to 30 April 2023. They are worth only about £83m market cap + £30m debt ~ £115m... not bad I think